特别声明:中安联合保险经纪股份有限公司(下称“中安联合”)是由中国保险监督管理委员会批准设立的保险经纪公司(京ICP备18005751号-7 经营保险经纪业务许可证:260676000000800 中国保监会网销许可),负责销售网站所载产品。仅向中安联合提供交易平台,而非保险公司的保险代理人,不参与保险相关的任何活动。

- 人在旅途®境外旅行保障计划

1、产品特色

- 1.价格细化至天,为您精打细算每一分钱。

- 2.市面上同一价格档位,保障覆盖广,保额较高的诚意之作。

- 3.钻石计划满足澳大利亚、芬兰等超高保额要求,黄金、钻石计划满足申根签证要求。

- 4.短期旅行最长可选择365天,覆盖更广,选择更灵活。

- 5.承保热门娱乐项目:热气球、滑雪、潜水、骑马、攀岩等热门娱乐运动。

- 6.航班延误赔偿不限定延误原因,只要延误就有赔偿。

- 7.承保全球绝大多数国家的旅行!

- 8.特别承保多数保险公司除外的手提电脑及手机!

- 9.24小时全球旅行救援,提供国际医疗救援、旅行相关咨询服务及紧急旅行协助等多项服务,我们关心的不止是意外,更包括您的旅行质量!

- 10. 最多五个工作日内完成理赔审核并出具赔款通知书,理赔程序简单快捷!

2、保障范围摘要

3、保险基准费率表(含适用的增值税)

4、特别提醒

- 1.本保险不承保任何直接或间接由于计划或实际前往或途经缅甸、俄罗斯、乌克兰、克里米亚和塞瓦斯托波尔、叙利亚、委内瑞拉、古巴、阿富汗、白俄罗斯、伊朗、朝鲜、尼泊尔或在上述国家或地区旅行期间发生的保险事故。 1.This insurance does not cover any insurance accident directly or indirectly caused by the planned or actual travel to or through Myanmar, Russia, Ukraine, Crimea and Sevastopol, Syria, Venezuela, Cuba, Afghanistan, Belarus, Iran, North Korea, Nepal, or during the travel in the above countries or regions

- 2.本保险对于任何直接或间接由于前往或途经以下国家或地区发生的事故不提供救援服务。1)亚洲:英属印度洋领地,Cocos Islands,东帝汶,朝鲜,缅甸,伊朗,叙利亚,阿富汗;2)欧洲:克里米亚地区和扎波里兹日亚、赫尔松、顿涅茨克和卢汉斯克人民地区、白俄罗斯、俄罗斯联邦;3)南美洲:委内瑞拉;4)非洲:厄立特里亚,索马里,圣赫勒拿岛,西撒哈拉,利比亚,刚果(金),乍得,中非,科摩罗;5)大洋洲:美属萨摩亚群岛,布韦岛,圣诞岛,法属南部领地,赫德岛和麦克唐纳群岛,基里巴斯,马歇尔群岛,麦克罗尼西亚,瑙鲁,尼乌亚岛,皮特凯恩岛,所罗门群岛,南乔治亚和南桑威治,托客劳群岛,汤加,图瓦卢,US Minor Outlying Islands,瓦努阿图,瓦利斯和富图纳群岛;6)南极洲。 2. This insurance does not provide assistance services for any accident directly or indirectly caused by customers going to or passing through the following countries or regions. 1)Asia: British Indian Ocean Territory, Cocos Islands, East Timor, North Korea, Myanmar, Iran, Syria, Afghanistan; 2)Europe: the Crimea Region and the People's regions of Zaporizzhya, Kherson, Donetsk and Luhansk, Belarus, the Russian Federation; 3)South America: Venezuela; 4)Africa: Eritrea, Somalia, Saint Helena, Western Sahara, Libya, Democratic Republic of the Congo, Chad, Central Africa, Comoros; 5)Oceania: American Samoa, Bouwe Island, Christmas Island, French Southern Territory, Heard Island and MacDonald Islands, Kiribati, Marshall Islands, Micronesia, Nauru, Niuya Island, Pitcairn Island, Solomon Islands, South Georgia and South Sandwich, Tokelau Islands, Tonga, Tuvalu, US Minor Outlying Islands, Vanuatu, Wallis and Futuna Islands; 6)Antarctica.

- 3.若您在旅游途中需要任何紧急援助,请直接拨打24小时紧急援助热线:+86 021-61297926。另外,您可在工作时间(周一至周日8:30-21:30)致电95550,或登陆本公司网站www.axa.cn查询您保障的详细信息。 3.Please call our 24-hour hotline line at +86 021-61297926, should you need any travel assistance service. You could also contact 95550(Monday to Sunday, 8:30-21:30) or enter our homepage www.axa.cn to verify your coverage. 3.若您在旅游途中需要任何紧急援助,请直接拨打24小时紧急援助热线:+86 10 63319211或4009960007,或登陆本公司网站www.besttrav.com 查询您保障的详细信息。 3.You could contact +86 10 63319211 or 4009960007( Twenty-Four Seven) or enter our homepage www.besttrav.com to verify your coverage.

- 4.根据保监发〔2015〕90号的规定,对于父母为其未成年子女投保的人身保险,在被保险人成年之前,各保险合同约定的被保险人死亡给付的保险金额(包括在所有商业保险公司所购买的保险,但不包括投资连结保险、万能保险以及航空意外伤害保险)总和、被保险人死亡时各保险公司实际给付的保险金总和:投保年龄不满10周岁的,不得超过人民币20万元;投保年龄已满10周岁但未满18周岁的,不得超过人民币50万元,故对于被保险人的投保限额超过上述规定的,我司不再承保,若尚未达到限额的,本公司仅就差额部分进行承保。 4.Any insured under 18 years old, if he/she, before the inception of this policy, has other insurance policy/policies that offer(s) death benefit (except unit-linked insurance, universal insurance and aviation personal accident insurance), the death benefits provided by this policy will be excess in all instances to the other insurance policy/policies and the total death benefits of the other insurance policy/policies and this policy shall not exceed the death benefits limit- RMB 100,000 for person under 10 years old or RMB 500,000 for person from 10 to under 18 years old as specified by China Insurance Regulatory Committee in regulation (2015) #90. (751)

- 5.本计划的成年人投保年龄为18周岁至90周岁,未成年人的投保年龄为30天至17周岁。71周岁至80周岁的被保险人,其“意外事故身故及残疾保险金”、“公共交通意外保险金”和“急性病身故(含猝死)”和“意外事故及疾病医疗费用补偿”的保险金额为保障利益表中所载金额的一半,保险费维持不变,81-90周岁的被保险人其上述保额为保障利益表中所载金额的四分之一,保费维持不变。 5.The adult Insured Persons must be from 18 to 80 years of age inclusive and the juvenile Insured Persons must be from 30 days to 17 years old upon application. For any Insured Person aged from 71 to 80 years old, Maximum Limits under "Accidental Death, Burns & Dismemberment" , " Public Transport ", "Acute disease Death(incl. Sudden Death) " and "Accidental & Sickness Medical" benefits will be reduced to half of Limits as above table stated while the premium remains unchanged, for any Insured Person aged from 81 to 90 years old, Maximum Limits for those benefits mentioned above will be reduced to a quarter of limits as stated on the policy while the premium remains unchanged. #2370

- 6.本保险单保障被保险人从中国大陆地区出发至全球范围内的海外旅行,涵盖地区包括但不仅限于美国、加拿大、澳大利亚、新西兰、韩国、日本以及香港、澳门和台湾等国家和地区以及所有申根国家,包括但不限于奥地利、比利时、丹麦(含格陵兰岛及法罗群岛)、芬兰、法国、德国、冰岛、意大利、希腊、卢森堡、荷兰、挪威、葡萄牙、西班牙、瑞典、瑞士、波兰、捷克、爱沙尼亚、立陶宛、斯洛伐克、匈牙利、斯洛文尼亚、拉脱维亚、马耳他及列支敦士登、克罗地亚等国家和地区。 6.We provide worldwide travel insurance for the insured persons as stated in this policy schedule, which covers travels departure from mainland China to the countries and areas including but not limited to U.S.A., Canada, Australia, New Zealand, South Korea, Japan, Hong Kong, Macau, and Taiwan Province and all Schengen countries including but not limited to Austria, Belgium, Denmark(incl. Greenland and Faroe Islands), Finland, France, German, Iceland, Italy, Greece, Luxemburg, Holland, Norway, Portugal, Spain, Sweden, Switzerland, Poland, Czech, Estonia, Lithuanian, Slovak, Hungary, Slovenia, Latvia, Malta and Liechtenstein, Croatia. (8)

- 7.任何在下列期间发生的或由下列原因造成的保险事故,本公司不负任何赔偿责任:战争、军事行动或武装叛乱期间;侵略、外敌行为、敌对(不论是否宣战)、内战、叛乱、革命、起义、军事行动或篡权、受任何政府或国家权力机构的指挥对财产的没收或国有化或征用或毁坏或破坏的、暴乱骚乱。本计划不承保前往现阶段已处于战争状态、已被宣告为紧急状态;或在将来处于战争状态、被宣告为紧急状态的地区和国家的旅行者。 7.This Policy does not cover claims: directly or indirectly occasioned by, happening through or in consequence of: During war, military operations, insurrection or military rising; war or relevant operations (whether war be declared or not), act of terrorism, invasion, hostilities, act of foreign enemy, civil war, strike, insurrection, civil commotion, rebellion, revolution, civil rising, military or usurped power. (3)

- 8.除保单中明确约定特别承保由被保险人投保前患有的心脑血管疾病、高血压及糖尿病导致的医疗费用,赔付金额以保单载明的保险金额为限,本公司不负责赔偿由下列原因造成的保险事故:受保前已存在之病症或未向本公司声明并由本公司书面接受被保险人的既往身体状况、慢性病、精神病、精神分裂、艾滋病、性传播疾病、遗传性疾病、先天性疾病、真菌感染疾病或缺陷、先天性畸形、牙齿治疗(但因意外伤害事故导致的必须进行的牙科门诊治疗不在此限)、预防性手术等非必须紧急治疗的手术、器官移植。 8.The insurer shall not bear any indemnity liability for any insured accident arising from the following causes:pre-existing condition or the insured person's previous health conditions not declared to the insurer and not accepted by the insurer in writing, chronic disease, mental disease, schizophrenia, AIDS, sexually transmitted disease, hereditary disease, congenital disease,fungal infection disease or defect, congenital deformity, teeth treatment (except for the indispensable dentistry outpatient treatment caused from an injury accident), preventive operation or any other operation or organ transplant not in need of emergent treatment. #2132

- 9.本产品每人仅限购买一份。若被保险人自愿投保由本公司承保的多种综合保险(不包含团体保险),且在不同保障产品中有相同保险利益的,则本公司仅按其中保险金额最高者做出赔偿,并退还其它保险项下已收取的相应保险利益的保险费。 9.Each insured person can only be entitled one insurance plan under this product. If the applicant applies different insurance products from the Company (not including group insurance) and there are the same Benefits under different insurance products, the Company will indemnify the insured only one Benefit with the highest limit and refund the premium of other same Benefits when claim occurs.

- 10.全年保障每次旅行的保障期限最长为182天。 10.The maximum duration of each insured trip is 182 days for annual policy.

- 11.投保人可于保险合同成立后,保险责任开始前书面申请撤销本合同,本公司进行审查后符合条件的将退还已缴保费,保险合同关系自本公司同意退费之日解除。对于保险期间为一年的保单,投保人可于本合同有效期内至少提前三十天以书面形式向本公司申请退保,但本公司已根据本保险合同约定给付保险金的除外。本合同将于书面通知列明的合同终止日二十四时终止。退保时对于已经生效的保险天数,本公司将按照同一保险计划项下的短期保障计划结算保费。已经生效的保险天数超过180天的,但客户申请退保的,保费将不再退还。 11.The policyholder may cancel the policy before the inception date subject to the cancellation terms & condition. The Insurer will then refund the premium accordingly. For the annual policy, the policyholder may, within the insurance period, notify the insurer in writing at least 30 days in advance to terminate the insurance contract, except that the insurer has paid the benefits pursuant to this Contract. The Contract will be terminated at twenty-four (24) o'clock on the day in the written notice. The insurer will charge the premium according to the short-term plan based on days expired and refund overcharged premium if there is any. However if the insurance has been valid for more than 180 days, the premium will not be refundable.

- 12.本保险仅承保被保险人从中国大陆出发,返回中国大陆的旅行。本保险不承保外籍人士返回原籍国的旅行。本保险的保险期间必须完整覆盖被保险人离开及返回到日常生活、工作所在地的旅行期间。 12.The insurance only covers the journey of Insured Person starting from mainland China and returning to mainland China. The insurance does not cover the journey of expatriate returning to his/her home country. The insurance period must completely cover the whole trip from the insured person leaves till he returns to his/her normal living or working place.

- 13.本保险不承保在投保本保障计划时已置身于境外的被保险人。 13.The insurance does not cover the journey of the Insured Person who is outside mainland China when he/her applies for the insurance.

- 14.本保险不承保任何直接或间接由于计划或实际前往或途径对中华人民共和国公民施行电子签、免签、落地签政策的国家或在上述国家旅行期间发生的旅行延误、行李延误、个人财产损失、旅行证件损失。 14.This policy will not cover any travel delay, baggage delay, personal financial losses or loss of travel documents arising directly or indirectly from planned or actual travel in, to, or through countries who require visa on arrival and e-visa or those who do not require visa for Chinese citizens.

- 15.本保险合同所载各项保险利益不承保投保人或者被保险人在递交投保申请或者为该次旅行预定相关旅行服务时已知已存在可能导致发生该保单上所载任何一项保险事故的情况或者条件,包括但不限于旅行服务提供商、政府、媒体等第三方机构已经宣布或已经发生或者可能发生的任何恶劣天气、自然灾害、罢工抗议、及旅游提醒。 15.The insurer shall not bear any indemnity liability if the policyholder/insured is aware the pre-existing insured accident or condition when applying the insurance or booking travel service, including but not limited to travel service provider, government, media have declared any pre-existing or possible severe weather, natural disaster, strike parade and travel caution.

- 16.本保险扩展承保被保险人参加乘风滑翔、滑翔、单人跳伞、地上坑洞勘探活动,或置身于任何飞机或者空中运输工具(以乘客身份搭乘民用或 商业航班者除外)期间发生的意外事故,但其“意外事故身故及残疾保障金”、“意外事故及疾病医疗费用补偿”及“紧急医疗运送和送返”的保险金额,仅为保障利益表中所载金额的25%,同时保险费维持不变。 16.Expansively, the insurance covers the accidents occurred when the insured participates in the following high risk sports or activities: hang gliding, paraglider, solo parachuting, caving or flying in any aircraft(excluding those taking a commercial or civil aircraft as passengers), and the Maximum Limits under “Accidental Death & Dismemberment”, “Medical Reimbursement” and “Emergency Evacuation & Repatriation” benefits will be reduced to 25% of Limits as above table stated while the premium remains unchanged.

- 17.保险人不应当被认为对下列情形提供任何保险保障或负责支付任何索赔或提供任何利益:如提供该任何保险保障、支付该任何索赔或者提供该任何利益会使保险人受到联合国决议或者中国、欧盟、英国或美国的贸易或经济制裁、法律或法规下的任何制裁、禁令或者限制。 17.The Company shall not be deemed to provide cover and shall not be liable to pay any claim or provide any benefit hereunder to the extent that the provision of such cover, payment of such claim or provision of such benefit would expose the Company to any sanction, prohibition or restriction under United Nations resolutions or the trade or economic sanctions, laws or regulations of the P.R.C, European Union, United Kingdom or United States.

- 18.本保险单、投保单/投保申请、保险条款、批单或备注(如有)及其他约定书(如有)均为保险合同的构成部分。 18.This insurance policy, application form, insurance clauses, endorsement or remarks (if any) and other agreements (if any) are all part of the insurance contract.

5、主要责任免除

- 1、 战争、军事行动、暴乱、罢工或武装叛乱期间;侵略、外敌行为、敌对(不论是否宣战)、内战、叛乱、革命、起义、军事行动或篡权、受任何政府或国家权力机构的指挥对财产的没收或国有化或征用或毁坏或破坏的、暴乱骚乱。

- 2、 任何生物、化学、原子能武器、原子能或核能装置所造成的爆炸、灼伤、污染或辐射。

- 3、 投保人的故意行为;或被保险人无论当时神志是否清醒,被保险人自致伤害或自杀。

6、24小时全球旅行援助服务一览

- 国际医疗救援:紧急医疗运送及送返、安排入院许可、费用垫付等

- 各种咨询服务:旅行、签证、天气和使领馆资讯等

- 特别协助:护照、行李遗失协助,紧急旅行协助

- 24小时紧急援助热线: +86 021-61297926 全球紧急援助24小时服务热线:+86 10-6331 9211

- 保单查询热线:95550 保单查询热线:400 996 0007

7、理赔指南

- 购买人在旅途®如需理赔服务,您可按照以下流程申请赔付:

- 1. 若您在旅游途中需要任何紧急援助,请直接拨打24小时紧急援助热线: +86 021-61297926。另外,您可在工作时间(周一至周日8:30-21:30)致电95550,或登陆本公司网站www.axa.cn 查询您保障的详细信息。 1. 如果您在旅游途中遇到意外,如在境内或境外急需获得医疗救援服务,可以拨打安盛保险救援机构服务热线(+86)10 6331 9211或BESTTRAV.COM客服电话400 996 0007,我们会第一时间为您的提供医疗安排和救助服务。

- 2.在您治疗完毕且不再发生医疗费用之后,请登录besttrav官网会员在线快速理赔通道,进入系统理赔管理功能.

- 3.输入保单号,被保险人证件号查询并完善申请信息.

- 4.按步骤填入申请索赔事项信息并将证明材料拍照上传至BESTTRAV.COM快捷理赔系统.

- 5.提交并等待开案审核.核赔通过后按照索赔申请表地址将表格及证明材料一并寄往BESTTRAV.COM理赔中心.

- 6. 保险赔款将在收到您的原件证明材料且核对无误后10个工作日内支付到索赔申请人的银行账户。

客户申请理赔,并经保险公司核赔确定的理赔金,由安盛财产保险股份有限公司将理赔款转入受益人确认的银行账户。

8、重要提示

- 本文所述只提供概要介绍,并不涵盖所述保险合同所有的条款、条件和除外事项。如欲了解保险范围和除外事项的详细內容,请参阅

人在旅途®境外旅行保障计划保险条款 。

人在旅途®境外旅行保障计划保险条款 。 - 本产品提供全流程线上服务:

- 在线咨询服务:

- 在线购买流程:

- 1.填写旅行信息

2.填写投保单信息

3.发送投保要约邮件

4.邮件中获取要约码,填入页面或直接在邮件中确认投保单信息并支付保费

5.收取保单/发票完成投保流程 - 在线理赔流程:

- 1.输入保单号、被保险人证件号新增索赔事项

2.填写完善被保险人信息,上传身份证明文件

3.新增索赔事顶填写案件信息上传赔案相关证明文件材料

4.开案等待理赔部门审核

5.缺少材料可补充上传

6.材料齐全符合理赔要求审核通过

7.理赔员发送表格根据要求安排回传、寄送必要材料

8.发放赔款完成理赔流程 - 本产品提供的保费支付方式:

- 在线支付:

微信支付/支付宝支付/paypal在线支付

线下支付:

银行对公转账 :

帐号:1102 2401 0400 0015 4

户名:中安联合保险经纪股份有限公司

开户行:农行新街口支行 - 本产品提供电子/纸质的保单和发票:

- 电子保单/发票递送方式:

客户如果选择电子保单/发票,购买成功后,系统会自动发送电子保单/保险条款/电子发票给投保人邮箱,同时提供在线页面自助下载.

纸质保单/发票递送方式:

电子发票效力等同于纸质发票。纸质发票在申请后7-14个工作日内寄送,使用到付方式邮寄

对于开具纸质发票的保单,在发生退保时,须将发票原件交回百川保险besttrav,并由投保人承担由此产生的快递费用。 - 保单验真方式:

- 本产品投保成功之后可从下列渠道中进行验真:

百川保险besttrav保单验真方式:

在线网址验真(点击进入)

客服电话验真:400 996 0007

安盛天平财产保险有限公司:

在线网址验真(点击进入)

客服电话验真:95550

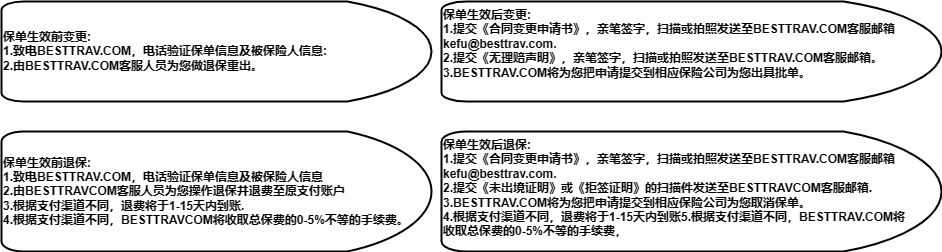

通过本网站购买本保险的客户,后续的保单信息变更、退保或理赔服务,可以通过400电话或在线客服方式等向本网站提出申请,我们根据保险公司的相关服务政策,与保险保险公司协同办理。 - 变更和退保流程:

-

- 保险公司告知:

- 投保人或被保险人对于本公司询问的告知事项应据实说明。

(1) 若因故意未履行如实告知义务,足以直接影响本公司决定是否同意承保本合同或提高保险费率的,无论当时保险事故是否发生,本公司有权按照相关法律规定解除本合同,并不退还保险费。对于本合同解除前所发生的保险事故,本公司不承担赔偿或者给付保险金的责任。若上述故意未履行如实告知义务仅直接影响本公司决定是否同意承保某一被保险人,则其被保资格将被取消;对于取消其被保资格前所发生的保险事故,本公司不承担任何保险责任。

(2) 若因重大过失未履行如实告知义务,足以直接影响本公司决定是否同意承保本合同或提高保险费率的,无论当时保险事故是否发生,本公司有权按照相关法律规定解除本合同,并无息退还保险费。若上述因重大过失未履行如实告知义务仅直接影响本公司决定是否同意承保某一被保险人,则其被保资格将被取消,本公司将无息退还该被保险人相应部分的保险费。若因重大过失未履行如实告知义务,对于本合同解除前或取消被保资格前所发生的保险事故有严重影响的,本公司对该保险事故不承担任何保险责任。

(3) 若未履行如实告知义务足以直接影响本公司决定是否提高保险费率的,而本公司同意继续承保的,投保人应向本公司补缴自本合同的生效日起累计增加的保险费及其利息 - 本保险产品由百川保险besttrav代理销售,百川保险besttrav位于北京,允许销售区域全国(港、澳、台除外)。

- 本产品为在线销售,由百川保险besttrav与安盛天平财产保险有限公司实现系统对接出单,百川保险besttrav将客户所填信息发送至安盛天平财产保险有限公司核心系统,自动核保,并出具电子保单,由客人自行下载或发送至客人邮箱,实现承保。

- 安盛财产保险股份有限公司全国唯一咨询热线

咨询电话:95550 工作时间:(周一至周日8:30至21:30) - 公开信息披露:

-

了解更多,请点击查看《公开信息披露》

9、保险表款名称清单

- 安盛天平个人旅行人身意外伤害保险(2022版A款)(互联网专属)条款 C00007832312022062713653

- 安盛天平附加个人旅行急性病身故保险(2022版)(互联网专属)条款 C00007832622021120908753

- 安盛天平附加个人旅行医疗费用保险(2022版A款)(互联网专属)条款 C00007832522022102405941

- 安盛天平附加个人旅行每日住院津贴收入保障保险(2022版)(互联网专属)条款 C00007832522021120919323

- 安盛天平附加个人旅行慰问及探访费用保险(2022版)(互联网专属)条款 C00007831922021121012413

- 安盛天平附加个人旅行紧急手机费用保险(2022版)(互联网专属)条款 C00007831922021120910733

- 安盛天平附加个人境外旅行绑架及劫持津贴保险(2022版)(互联网专属)条款 C00007831922021120910253

- 安盛天平附加个人旅行家居财物保障保险(2022版)(互联网专属)条款 C00007832122021120911153

- 安盛天平附加个人旅行个人责任保险(2022版)(互联网专属)条款 C00007830922021120910843

- 安盛天平附加个人旅行全球紧急救助保险(2022版)(互联网专属)条款 C00007831922021121012753

- 安盛天平附加个人旅行延误损失补偿保险(2022版)(互联网专属)条款 C00007831922021121012723

- 安盛天平附加个人旅行行李延误保险(2022版A款)(互联网专属)条款 C00007831922021121420143

- 安盛天平附加个人旅行变更保险(2022版A款)(互联网专属)条款 C00007831922022081822463

- 安盛天平附加个人旅行者行李及随身财产保险(2022版)(互联网专属)条款 C00007832122021121012673

- 安盛天平附加个人旅行者钱财及旅行证件遗失保险(2022版)(互联网专属)条款 C00007832122021121012453

- 安盛天平附加个人旅行者信用卡盗刷保险(2022版)(互联网专属)条款 C00007832122021121013013

- 安盛天平附加个人旅行租车责任保险(2022版)(互联网专属)条款 C00007830922021120910763

- 注:请您点击条款名称查看完整条款内容 Remark: Pls click the name of Policy Wording for the details..