特别声明:中安联合保险经纪股份有限公司(下称“中安联合”)是由中国保险监督管理委员会批准设立的保险经纪公司(京ICP备18005751号-7 经营保险经纪业务许可证:260676000000800 中国保监会网销许可),负责销售网站所载产品。仅向中安联合提供交易平台,而非保险公司的保险代理人,不参与保险相关的任何活动。

- 自由人®旅行保障互联网版

1、产品特色

24小时全国紧急医疗救援和旅行支援服务

承保热门娱乐运动: 山地穿越、沙漠穿越、滑雪、潜水、游泳、骑马、自行车、自驾车、乘风滑翔、滑翔、单人跳伞、探险活动等

备有短期和全年计划供您灵活选择

自由人计划三承保区域至全球范围,包括中国大陆地区及港、澳、台地区

2、保障范围摘要

| 产品名称 | 史带自由人旅行保障互联网版 | ||

| 投保年龄 | 14天-90周岁 | ||

| 保障期限 | 1天-1年,可选 | ||

| 保险责任 | 境内计划一 | 境内计划二 | 全球计划三 |

| 保障范围 | 境内旅行 | 境内旅行 | 境内及境外旅行 |

| 意外身故及伤残 | 100,000 | 200,000 | 500,000 |

| 滑水、滑冰、滑雪、马术培训、攀岩运动意外身故、伤残 | 100,000 | 200,000 | 500,000 |

| 滑水、滑冰、滑雪、马术培训、攀岩运动意外医疗 | 20,000 | 50,000 | 300,000 |

| 乘风滑翔、滑翔、单人跳伞、地上坑洞勘探、雪道外滑雪活动意外身故、伤残 | 10,000 | 20,000 | 50,000 |

| 乘风滑翔、滑翔、单人跳伞、地上坑洞勘探、雪道外滑雪活动意外医疗 | 2,000 | 5,000 | 30,000 |

| 急性病身故 | 10,000 | 10,000 | 30,000 |

| 医疗费用补偿 *其中境内旅行的疾病医药补偿 |

20,000 / |

50,000 5,000 |

300,000 30,000 |

| 亲友慰问探访费用 | / | 8,000 | 10,000 |

| 意外每日住院津贴 (100元/天,次免赔10天 ) | / | 1,000 | 5,000 |

| 紧急医疗运送及送返(该医疗运返责任不承担尼泊尔救援责任) | 60,000 | 100,000 | 500,000 |

| 身故遗体送返(其中丧葬费以16,000元为限) | 16,000 | 20,000 | 500,000 |

| 行李延误 (每6小时赔偿限额:RMB500元 ) | / | / | 1,000 |

| 旅行延误 (每4小时赔偿限额:RMB300元 ) | / | / | 600 |

| 个人随身财物 (每件或每套行李或物品赔偿限额为RMB1000 ) | / | / | 3,000 |

| 旅行个人责任 | 80,000 | 80,000 | 100,000 |

3、保险基准费率表(含适用的增值税)

| 保险费(人民币:元) | |||

| 保险期间 | 计划一 | 计划二 | 计划三 |

| 1天 | 5 | 15 | 45 |

| 2天 | 10 | 25 | 60 |

| 3天 | 15 | 35 | 75 |

| 4天 | 20 | 45 | 90 |

| 5天 | 25 | 55 | 105 |

| 6-365天/超过5天后, 每增加一天(不到一天按一天计) | 25+3*增加的天数 | 55+5*增加的天数 | 105+10*增加的天数 |

| 全年(单次旅行最长30天) | 255 | 510 | 1330 |

4、特别提醒

- 1.本保险产品仅由史带财产保险股份有限公司(以下简称:史带财险)承保,史带财险目前在北京市、上海市、广东省、山东省、江苏省、浙江省(除宁波市)开设了分支机构。本产品的销售区域为全国,目前史带财险部分业务无法在线完成批改、保全、退保、理赔,如您有相应需求, 可联系史带财险落地分支机构或线下合作机构的相关人员。如您所在地无史带财险分支机构可能存在服务不到位的情况,您可以拨打4009995507客服热线。

- 2.本保险计划所有保险责任、责任免除及相关事项均以《史带财产保险股份有限公司旅行人身意外伤害保险互联网版》及其附加险条款为准。

- 3.适用计划一、计划二:本保险承保年龄为出生满14天至90周岁(含本数),以保险起期时被保险人的周岁年龄为准。71至80周岁(含本数)的被保险人,其涉及“意外身故、伤残”、“急性病身故”和“医疗费用”保障的保险金额为保险单所载金额的一半;81至90周岁(含本数)的被保险人,其涉及“意外身故、伤残”、“急性病身故”和“医疗费用”保障的保险金额为保险单所载金额的四分之一,保险费维持不变。

- 4.适用计划三:本保险承保年龄为出生满14天至90周岁(含本数),以保险起期时被保险人的周岁年龄为准。若为境内旅行,71至80周岁(含本数)的被保险人,其涉及“意外身故、伤残”、“急性病身故”和“医疗费用”保障的保险金额为保险单所载金额的一半;81至90周岁(含本数)的被保险人,其涉及“意外身故、伤残”、“急性病身故”和“医疗费用”保障的保险金额为保险单所载金额的四分之一,保险费维持不变。若为境外旅行,71至80周岁(含本数)的被保险人,其涉及“意外身故、伤残”和“急性病身故”保障的保险金额为保险单所载金额的一半;81至90周岁(含本数)的被保险人,其涉及“意外身故、伤残”和“急性病身故”保障的保险金额为保险单所载金额的四分之一,保险费维持不变。

- 5.根据中国保监会关于父母为其未成年子女投保以死亡为给付保险金条件人身保险有关问题的通知:对于父母为其未成年子女投保的人身保险,在被保险人成年之前,各保险合同约定的被保险人死亡给付的保险金额总和、被保险人死亡时各保险公司实际给付的保险金总和按以下限额执行:(一)对于被保险人不满10周岁的,不得超过人民币20万元;(二)对于被保险人已满10周岁但未满18周岁的,不得超过人民币50万元。若被保险人是未成年人时,投保人必须是其父母或监护人。

- 6.在保单有效期内,每位被保险人投保同一产品(包括同一产品的同一计划或不同计划)限投保壹份, 以最先投保之保单为有效,超出部分视为无效,保险费将无息退还。

- 7.若被保险人在任意渠道投保由史带财险承保的多份“意外身故、伤残”、“急性病身故”“医疗费用”保障(不包括团体保险),则史带财险仅按其中保险金额最高者做出赔偿。

- 8.如投保全年计划,保险期间内不限旅行次数,但每次旅行最长承保期间为30天。

- 9.计划一及计划二适用:本保险仅承保在中华人民共和国大陆地区境内(不含香港、澳门、台湾地区)旅行期间的责任,可扩展承保被保险人境内日常居住地或日常工作地所在的市级行政区域内的旅行保障。

- 10.计划三适用:本保险承保全球(含境内、境外)旅行期间的责任,可扩展承保被保险人境内日常居住地或日常工作地所在的市级行政区域内的旅行保障。

- 11.本保单可支持投保当天生效,但当天生效的保单中,“旅行延误”及“行李延误”两项责任的生效时间为投保成功的次日零时。

- 12.仅计划三适用:本保险为本保单所载之被保险人在旅行期间提供24小时的保险保障,涵盖地区包括但不仅限于美国、加拿大、澳大利亚、新西兰、韩国、日本及香港、澳门和台湾等国家和地区以及所有申根国家包括但不仅限于奥地利、比利时、丹麦、芬兰、法国、德国、冰岛、意大利、希腊、卢森堡、荷兰、挪威、葡萄牙、西班牙、瑞典、瑞士、波兰、捷克、爱沙尼亚、立陶宛、斯洛伐克、匈牙利、斯洛文尼亚、拉脱维亚、列支敦士登公国、马耳他、保加利亚及罗马尼亚等国家和地区。

- 13.在任何情况下,史带财险不承保任何直接或间接前往或途径伊朗、朝鲜、乌克兰(克里米亚地区)、古巴、叙利亚以及投保时已经处于战争状态或已被宣布为紧急状态的国家或地区,或在上述国家或地区旅行期间发生的保险事故。根据联合国决议或根据美国、欧盟或其他可适用的经济制裁、法律和规定,如果史带财险承保、支付赔款或向被保险人提供任何其他利益的行为,将会导致保险人受到任何制裁、禁令或限制的,则在上述范围内史带财险将不予承保、赔付或提供其他利益。若史带财险在本保险项下提供任何保险保障、利益或支付任何保险赔偿金会导致史带财险违反联合国决议项下的任何制裁、禁止性或限制性规定,或者违反中华人民共和国或美国颁布的任何经济贸易制裁、法律法规时,则史带财险在本保险项下不提供前述保险保障、利益,亦不支付前述保险赔偿金。

- 14.医疗机构:在中国境内(不包括香港、澳门、台湾地区) 的医疗机构:是指合法的二级及二级以上医保定点医院普通部或投保人与史带财险协商共同指定的医院或医疗机构。 在中国境外(包括香港、澳门、台湾地区)的医疗机构:是指史带财险认可的,根据所在国家法律合法成立、运营并符合以下全部标准的医疗机构:1)主要运营目的是以住院病人形式提供接待病患、伤者并为其提供医疗护理和治疗;2)在一名或多名医生的指导下为病人治疗,其中最少有一名合法执业资格的驻院医生驻诊;3)维持足够妥善的设备为病人提供医学诊断和治疗,并于机构内或由其管理的地方提供进行各种手术的设备;4)有合法执业的护士提供和指导的全职护理服务。医疗机构不包括以下或类似的医疗机构:1)精神病院;2)老人院、疗养院、戒毒中心和戒酒中心;3)健康中心或天然治疗所、疗养或康复院。4)所有中医院。

- 15.本保险计划所承保的运动包括:1)海拔6000米以下的休闲旅游、远足徒步、登山运动(不包括借助登山绳索、登山向导(非旅行社导游)完成的登山活动)、露营、固定路线洞穴体验;2) 定向运动、拓展活动、场地趣味活动;3)自行车运动、山地自行车越野、场地/越野轮滑、自驾车旅行;4)游泳、潜水(下潜深度不超过18米且在旅游景点的专业潜水教练指导下进行的休闲潜水活动)、溯溪、划船、帆船、帆板、皮划艇、漂流;5)人工场地攀岩及下降;6) 骑马游玩。

- 16.计划二及计划三适用:本保险计划所承保的高风险运动包括:滑水、滑冰、马术培训、海拔6000米以下在持正规经营执照的场地中进行的的滑雪运动、驾驶或乘坐滑翔翼、滑翔伞、跳伞、攀岩运动、蹦极等。

- 17.本保险计划不承保下列活动:1)被保险人以通过比赛夺标获取名利与财富为目的而从事紧张激烈训练和比赛的职业性的、竞技性的高风险运动;2)被保险人在未经旅行所在国的相关旅游管理部门许可的旅游景点或者在未取得相应高危险性体育项目经营许可的场所从事任何高风险运动;3)达到6000米及6000米以上海拔高度的攀登、登山、滑雪等户外运动;4)任何借助登山绳索或者非旅游社导游的登山向导完成的登山活动;5)极地探险、非固定路线洞穴探险或其他探险活动;6)下潜深度达到18米且借助水下供气瓶(非呼吸管)设备的潜水,或者被保险人未遵守相关安全指引和督导的潜水;7)武术比赛,摔跤比赛,赛马,特技,驾驶卡丁车,赛车,各种车辆表演。

- 18.本保险计划不承保因下列原因支出的费用:受保前已存在的疾病(指在本附加合同生效前 12 个月内:(1)被保险人已患有的疾病;(2)医生已建议被保险人接受医药治疗或提供医疗意见的症状、体征;或(3)被保险人已存在的且一个正常而审慎的人会寻求诊断、医疗护理或医疗治疗的症状、体征)及其并发症。

- 19.本公司不负责赔偿由下列原因造成的保险事故:慢性病、精神病、精神分裂、艾滋病、性传播疾病、遗传性疾病、先天性疾病、真菌感染疾病或缺陷、先天性畸形、预防性手术等非必须紧急治疗的手术、器官移植、非因意外伤害而进行的牙科治疗或手术的费用,以及任何原因导致的洗牙、牙齿美白、正畸、烤瓷牙、种植牙或镶牙等牙齿保健和修复或牙齿整形的费用。

- 20.旅行目的地为刚果金(刚果民主共和国)和尼日利亚,不承保任何医疗费用。

- 21.本保险单项下适用评残标准为《人身保险伤残评定标准及代码》(标准编号为JR/T 0083-2013):一级伤残100%、二级伤残90%、三级伤残80%、四级伤残70%、五级伤残60%、六级伤残50%、七级伤残40%、八级伤残30%、九级伤残20%、十级伤残10%(具体伤残评定标准内容可见文件《人身保险伤残评定标准及代码》(JR/T0083-2013))。

- 22."本保险的保险期间必须完整覆盖被保险人离开及返回到日常生活、工作所在地的旅行期间。以下情形必须经过百川保险的官方邮件(以besttrav.com作为域名)予以确认方可视为有效承保:1、参与高风险运动;2、保险期间未完整覆盖的行程。 投保人应当以发送邮件(域名同上)或其它书面形式与承保人特别确认方可有效。"

- 23.退保规则:保单生效前可申请全额退保,已生效的旅行险年单保单无理赔时,可按照条款退还未满期净保费部分(未满期净保费=净保费×(1-m/n),其中,m 为已生效天数,n 为保险期间的天数,经过日期不足一日的按一日计算)。已生效且已出行的旅行险短期保单,本保险不接受任何形式的退费。

- 24.信息披露:史带财险偿付能力信息和风险综合评级请参见我司官网公开信息披露专栏,网址如下:https://www.starrchina.cn/Information%20Disclosure/details.html?cid=43 ,偿付能力充足率达到监管要求。

5、24小时全球旅行支援服务

- 医疗咨询服务:安排就医、安排医疗转送、安排转送回国、垫付医疗费用。

- 遗体送返服务:运送回居住地、安排亲属处理后事

- 各种咨询服务:出国完整旅游信息、协助翻译、紧急口讯传递、法律援助服务、使领馆信息支持服务。

- 特别协助:旅行证件丢失援助、代寻并转送行李,紧急旅行协助。

- 全球紧急援助24小时服务热线:+86 10-6331 9211

6、理赔指南

- 联络BESTTRAV.COM,索取理赔申请表格。

- 填妥并递交索赔申请表格及有关证明文件,包括医院或医生报告、医药费用原始收据、警方或承运人证明等。

- BESTTRAV.COM将及时处理索赔,于十个工作日内给您回复。

7、百川保险重要提示

- 本文所述只提供概要介绍,并不涵盖所述保险合同所有的条款、条件和除外事项。如欲了解保险范围和除外事项的详细內容,请参阅

“自由人”旅行保障计划保险条款。

“自由人”旅行保障计划保险条款。 - 本文仅为一般性介绍,不得被视为咨询意见。如需要对您的保险需求或现有保障提供咨询,应联络史带保险服务热线。

- 本产品提供全流程线上服务:

- 在线咨询服务:

- 在线购买流程:

- 1.填写旅行信息

2.填写投保单信息

3.发送投保要约邮件

4.邮件中获取要约码,填入页面或直接在邮件中确认投保单信息并支付保费

5.收取保单/发票完成投保流程 - 在线理赔流程:

- 1.输入保单号、被保险人证件号新增索赔事项

2.填写完善被保险人信息,上传身份证明文件

3.新增索赔事顶填写案件信息上传赔案相关证明文件材料

4.开案等待理赔部门审核

5.缺少材料可补充上传

6.材料齐全符合理赔要求审核通过

7.理赔员发送表格根据要求安排回传、寄送必要材料

8.发放赔款完成理赔流程 - 本产品提供的保费支付方式:

- 在线支付:

微信支付/支付宝支付/paypal在线支付

线下支付:

银行对公转账 :

帐号:1102 2401 0400 0015 4

户名:中安联合保险经纪股份有限公司

开户行:农行新街口支行 - 本产品提供电子/纸质的保单和发票:

- 电子保单/发票递送方式:

客户如果选择电子保单/发票,购买成功后,系统会自动发送电子保单/保险条款/电子发票给投保人邮箱,同时提供在线页面自助下载.

纸质保单/发票递送方式:

电子发票效力等同于纸质发票。纸质发票在申请后7-14个工作日内寄送,使用到付方式邮寄

对于开具纸质发票的保单,在发生退保时,须将发票原件交回百川保险besttrav,并由投保人承担由此产生的快递费用。 - 保单验真方式:

- 本产品投保成功之后可从下列渠道中进行验真:

百川保险besttrav保单验真方式:

在线网址验真(点击进入)

客服电话验真:400 996 0007

史带财产保险股份有限公司:

在线网址验真(点击进入)

客服电话验真:95550

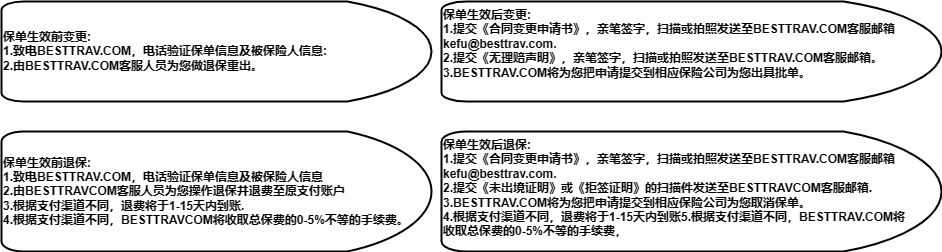

通过本网站购买本保险的客户,后续的保单信息变更、退保或理赔服务,可以通过400电话或在线客服方式等向本网站提出申请,我们根据保险公司的相关服务政策,与保险保险公司协同办理。 - 变更和退保流程:

-

- 保险公司告知:

- 投保人或被保险人对于本公司询问的告知事项应据实说明。

(1) 若因故意未履行如实告知义务,足以直接影响本公司决定是否同意承保本合同或提高保险费率的,无论当时保险事故是否发生,本公司有权按照相关法律规定解除本合同,并不退还保险费。对于本合同解除前所发生的保险事故,本公司不承担赔偿或者给付保险金的责任。若上述故意未履行如实告知义务仅直接影响本公司决定是否同意承保某一被保险人,则其被保资格将被取消;对于取消其被保资格前所发生的保险事故,本公司不承担任何保险责任。

(2) 若因重大过失未履行如实告知义务,足以直接影响本公司决定是否同意承保本合同或提高保险费率的,无论当时保险事故是否发生,本公司有权按照相关法律规定解除本合同,并无息退还保险费。若上述因重大过失未履行如实告知义务仅直接影响本公司决定是否同意承保某一被保险人,则其被保资格将被取消,本公司将无息退还该被保险人相应部分的保险费。若因重大过失未履行如实告知义务,对于本合同解除前或取消被保资格前所发生的保险事故有严重影响的,本公司对该保险事故不承担任何保险责任。

(3) 若未履行如实告知义务足以直接影响本公司决定是否提高保险费率的,而本公司同意继续承保的,投保人应向本公司补缴自本合同的生效日起累计增加的保险费及其利息 - 本保险产品由百川保险besttrav代理销售,百川保险besttrav位于北京,允许销售区域全国(港、澳、台除外)。

- 本产品为在线销售,由百川保险besttrav与史带财产保险股份有限公司实现系统对接出单,百川保险besttrav将客户所填信息发送至史带财产保险股份有限公司核心系统,自动核保,并出具电子保单,由客人自行下载或发送至客人邮箱,实现承保。

- 史带财产保险股份有限公司全国唯一咨询热线

咨询电话:400 999 5507 工作时间:(周一至周日8:30至21:30) - 公开信息披露:

-

了解更多,请点击查看《公开信息披露》

8、保险表款名称清单

- 史带财产保险股份有限公司旅行人身意外伤害保险互联网版 C00002332312023071105181

- 史带财产保险股份有限公司附加旅行高风险运动意外伤害保险互联网C版 C00002332322025041715903

- 史带财产保险股份有限公司附加旅行急性病身故保险互联网专属版 C00002332622023051591443

- 史带财产保险股份有限公司附加旅行医疗补偿保险互联网专属版 C00002332322023051591133

- 史带财产保险股份有限公司附加异地亲属慰问探望保险互联网专属版 C00002332122023051591063

- 史带财产保险股份有限公司附加旅行意外每日住院津贴保险互联网专属版 C00002332322023051591143

- 史带财产保险股份有限公司附加紧急医疗运送和送返保险互联网专属版 C00002332322023051591603

- 史带财产保险股份有限公司附加身故遗体送返保险互联网专属版 C00002332122023051591243

- 史带财产保险股份有限公司附加旅行行李延误保险互联网专属版 C00002332122023051591113

- 史带财产保险股份有限公司附加旅行延误保险C版条款 C00002331922025041715853

- 史带财产保险股份有限公司附加旅行随身财物保险互联网专属版 C00002332122023051591043

- 史带财产保险股份有限公司附加旅行个人责任及宠物责任保险互联网专属版 C00002330922023051591033